About this deal

IPO, stands for initial public offering, which is the process a new private company goes through to "go public" or become a publicly traded company on some index. demonstrate ability to synthesise and use information and materials from a variety of different sources to support an argument. Robert E. Wright and Vincenzo Quadrini. Money and Banking: "Chapter 2, Section 4: Financial Markets." pp. 3 [1] Accessed June 20, 2012 Professor Saunders has held positions on the Board of Academic Consultants of the Federal Reserve Board of Governors as well as the Council of Research Advisors for the Federal National Mortgage Association. In addition, Dr. Saunders has acted as a visiting scholar at the Comptroller of the Currency and at the Federal Reserve Banks of Philadelphia and New York. He was an academic consultant for the FDIC. He also held a visiting position in the research department of the International Monetary Fund. He is editor of Financial Markets, Instruments and Institutions. His research has been published in all the major money and banking and finance journals and in several books. In addition, he has authored or coauthored several professional books, including Credit Risk Measurement: New Approaches to Value at Risk and Other Paradigms, third edition, John Wiley and Sons, New York, 2010. In 2008, he was ranked as the most published author in the last SO years in the top seven journals in finance. Prasad, E.S. (2021). The Future of Money: How the Digital Revolution Is Transforming Currencies and Finance. Harvard University Press. ISBN 978-0-674-25844-0. LCCN 2021008025.

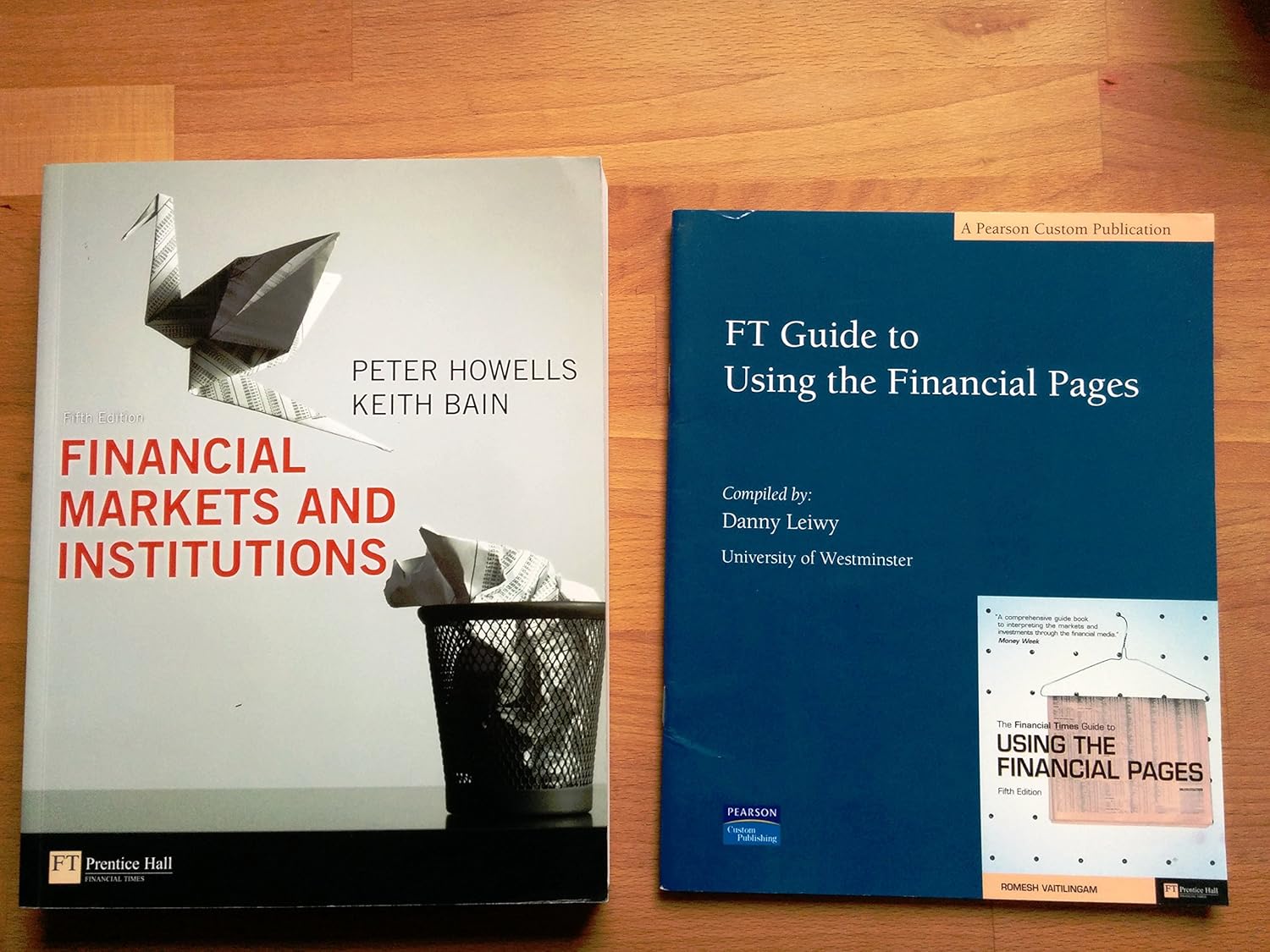

Financial Markets and Institutions, 10th edition | eTextBook Financial Markets and Institutions, 10th edition | eTextBook

Governments often find their spending requirements exceed their tax revenues. To make up this difference, they need to borrow. Governments also borrow on behalf of nationalized industries, municipalities, local authorities and other public sector bodies. In the UK, the total borrowing requirement is often referred to as the Public sector net cash requirement (PSNCR).

Financial Markets FAQs

Merton, Robert C. (1992). Continuous-Time Finance. Macroeconomics and Finance Series. Wiley. ISBN 978-0-631-18508-6. LCCN gb92034883. Data are provided at the European level (EU28), next divided between the old member states (EU15) and the new member states (NMS13), and finally at country level. In addition, there is a special chapter on financial integration between countries

What are financial markets and why are they important?

Relation between Bonds and Commodity Prices: With the increase in commodity prices, the cost of goods for companies increases. This increase in commodity prices level causes a rise in inflation. Fligstein, N. (2021). The Banks Did It: An Anatomy of the Financial Crisis. Harvard University Press. ISBN 978-0-674-25901-0. As the Global Financial Crisis that began in 2007 showed, when markets go wrong they can cause a lot of harm. That’s a very timely question, indeed: The pandemic has made the divergences and unevenness among Emerging Markets even larger. The pandemic-era policy responses varied substantially across countries, given their policy space. Some commonalities have become clear, however, even as various countries have been forced to improvise with policies tailored to the specific challenges each economy faces, as they struggle to navigate the daunting challenges that have confronted them during the pandemic. However, the extent to which this shift occurs will depend on a number of factors — including the ability of young economies to realize their demographic advantages, and the adaptability of aging economies to cope with their declining working-age populations.

Method of assessment

Second: We must pay close attention to financial-stability risks by improving climate risk-assessment frameworks and by developing proper mitigation strategies. That entails conducting diagnostic exercises to measure physical risks and transition risks, and carrying out climate-risk stress-testing for the banking and corporate sectors, when needed. Elton, E.J.; Gruber, M.J.; Brown, S.J.; Goetzmann, W.N. (2006). Modern Portfolio Theory and Investment Analysis. Wiley. ISBN 978-0-470-05082-8. LCCN 2007276500. Fourth, in geopolitics: The increasing multipolar nature of the world — with new actors gaining influence — will continue to have impacts on global trade, including supply chains, and financial networks. This could change the current multilateral landscape, and globalization more generally. Such changes must be resolved in mutually acceptable ways. The increasing number of large global corporations is also likely to present new challenges for policymaking across various areas, such as taxation, regulation, the provision of services and market power. Spencer, P.D. (2000). The Structure and Regulation of Financial Markets. Oxford University Press. ISBN 978-0-191-58686-6. LCCN 2001270248. Many individuals are not aware that they are lenders, but almost everybody does lend money in many ways. A person lends money when he or she:

Related:

Great Deal

Great Deal